On September 14, 2020, the Federal Acquisition Regulatory Council published the long anticipated proposed rule amending the Federal Acquisition Regulation (“FAR”) in accordance with President Trump’s Executive Order 13881, “Maximizing Use of American-Made Goods, Products, and Materials.” As previously discussed here, the Executive Order, signed on July 15, 2019, required significant changes to the implementing regulations of the Buy American Act, 41 U.S.C. §§ 8301-8305, changing policies dating back nearly 70 years. Accordingly, the proposed rule seeks to increase both the domestic content requirements and the evaluation preferences provided by the FAR for domestically manufactured goods, particularly with regard to domestic content requirements for steel or iron end products and products made predominantly from iron or steel. Most significantly, however, the proposed rule will revive heightened restrictions for commercially available-off-the-shelf (“COTS”) products that are made predominantly of iron or steel, requiring both the end product and 95 percent of the component parts be domestically sourced in order to qualify under the rule. The COTS exception remains available for other end products (that are not made predominantly of iron or steel), but the proposed rule still will impose heightened obligations and vendors now need to scrutinize their supply chains even more closely, even for COTS items. The FAR Council is accepting comments through November 13, 2020. A final rule is likely by early-2021.

Background

Generally speaking, the Buy American Act (“BAA”) restricts the country of origin of goods bought by the U.S. government, requiring the purchase of “manufactured articles, materials, and supplies that have been manufactured in the United States substantially all from articles, materials, or supplies, mined, produced, or manufactured, in the United States.” 41 U.S.C. § 8302(a). Numerous exceptions are available, however, allowing the government to purchase foreign-made products in many situations, particularly where a domestic alternative is not available or is too expensive. It is this last exception at which the new proposed rule takes particular aim.

Under the current FAR rules (particularly Subparts 25.1, 25.2, and 25.5), a domestic end product is one where: (1) the end-product is manufactured in the United States, and (2) more than 50 percent of the cost of all component parts are manufactured in the United States. FAR 25.101. Notably, if an end-product meets the FAR definition of a COTS product, then (since 2009, and pursuant to 41 U.S.C. § 1907) the second part of this test has been waived. FAR 25.101(a)(2). Practically speaking, this means that for more than a decade vendors have had more flexibility in selling COTS products to the government, with the vendor required only to know where the end product was manufactured, not necessarily where the component parts were sourced.

The proposed rule would amend several of these provisions, with at least three key effects:

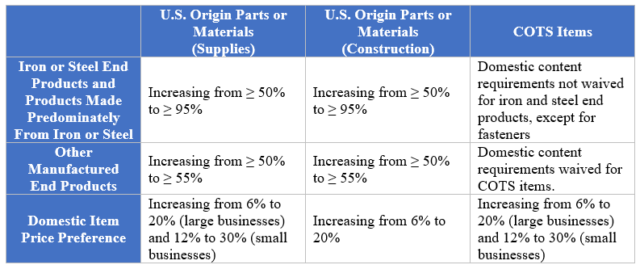

- Increasing the domestic content requirement – to 55 percent for most products, and to 95 percent for iron or steel (and products made predominantly from iron or steel);[1]

- Removing the COTS exception for iron or steel products (and products made predominantly from iron or steel); and

- Increasing the evaluation preferences for domestic end products (as compared to foreign products), requiring a foreign-made alternative to be between 20-30 percent cheaper than the domestic product in order for a BAA price waiver to apply.

Increasing Domestic Content Requirements

As discussed above, the current requirements of the BAA mandate that more than 50 percent of the cost of all component parts must be manufactured in the United States. This requirement dates back to the 1950s and President Eisenhower, interpreting the requirement that a product must be manufactured “substantially all from articles, materials, or supplies, mined, produced, or manufactured, in the United States.” 41 U.S.C. § 8302(a) (emphasis added). But, as required by Executive Order 13881, the proposed rule seeks to increase this requirement to at least 55 percent (with the realization that the percentage may climb even further in time). As such, the proposed rule updates the FAR 25.101 definitions both of “domestic construction material” and “domestic end products” (and corresponding clauses at FAR 52.225-1, 52.225-2, 52.225-9) to reflect this increase. The definitions also will be updated to reflect the long standing policy that “components of unknown origin are treated as foreign.”

There is one key thing to be aware of, however. Though the 55 percent domestic content requirement applies to most manufactured goods, it does not apply to products that are made predominantly from iron or steel. As detailed below, those types of products now are in a new class by themselves.

New 95 Percent Domestic Content Requirements for Iron and Steel (As Well As Products Made Predominantly From Iron or Steel)

The Executive Order continued President Trump’s push for increased reliance on domestic iron and steel, creating a new higher domestic content standard for iron and steel end products. Currently, the BAA does not differentiate between steel and iron and other manufactured end products. But under the proposed rule the domestic content requirement for iron and steel end products now will be 95 percent. Practically speaking, this means that all iron and steel end products must be made in the U.S., and the component materials must be sourced from the U.S. The “5 percent” permitted foreign content is more in the form of a kind mercy – recognizing that few things in an international supply chain are ever “100%” anything. The 5 percent allows for little mistakes, but not much more.

This change, distinguishing between iron and steel and other manufactured end products, also is reflected in the FAR’s proposed definitions for “domestic construction materials” and “domestic end products.” But the proposed rule also introduces new definitions for manufactured items, carving out a separate test to determine place of manufacture for items made “predominantly of iron or steel or a combination of both” – meaning “the cost of the iron and steel content in an item exceeds 50 percent of the total cost of all its components.” Under these circumstances, an end product is manufactured in the U.S. only if the “cost of iron and steel not produced in the United States (excluding fasteners) as estimated in good faith by the contractor, constitutes less than 5 percent of the cost of all the components used in the end product.” The proposed rule further explains “produced in the United States” means “that all manufacturing process of the iron or steel must take place in the United States, except metallurgical processes involving refinement of steel additives.” To be clear, this is a high bar. In fact, products made predominantly from iron or steel soon will be subject to significantly higher BAA requirements than ever before.

Notably, the FAR Council recognizes the difficulty that lies in estimating the costs of foreign iron and steel content, requiring only a “good faith estimate” by the contractor to determine both if a product is “predominantly made from iron and steel,” and whether the iron and steel content exceed the 95 percent threshold. Further, a contractor’s component requirement is measured by total cost, not cost of component parts. The FAR Council explained “the domestic content test for the iron and steel items does not require tracking of all components, only a good faith assurance that not more than 5 percent of the iron and steel content is foreign.” However, the proposed rule does little to alleviate any concerns contractors may have for future government interpretation of the vague “good faith assurance” standard.

No COTS Exception for Iron and Steel Products (And Products Made Predominately From Iron or Steel)

As discussed above, since 2009, the FAR has waived BAA restrictions for COTS items, preferring to take advantage of commercial products to the maximum extent possible. This remains the case for most products, but the proposed rule would remove the exception for products made predominately from iron or steel. The proposed rule explains the bulk of iron and steel products acquired by the Government are, in fact, COTS items used in construction material, thus concluding that leaving the COTS exception in place for products made predominately from iron or steel would vitiate the Executive Order mandate preferring domestic iron and steel.

Fortunately, the waiver still is applicable to iron and steel fasteners – defined as a “hardware device that mechanically joins or affixes two or more objects together” – as well as to items not predominantly made of iron or steel. Thus, COTS end products manufactured in the United States (without regard to components or source materials) still will qualify as a “domestic end product” under the BAA, so long as they are not made predominately from iron or steel and so long as they are fasteners.

Two little points are worth noting here about fasteners. First, this exception for COTS fasteners should offer significant relief to suppliers, as most commercial fastener manufacturers simply do not track where the metals were sourced – the commercial market does not care, and neither do most buyers. This relief is welcome. Second, the COTS fastener exception under the BAA – for which COTS fasteners can be purchased – is distinct from the Department of Defense Specialty Metals requirements – for which a COTS exception only is available in limited circumstances. See DFARS 225.7003-3(b)(2)(i)(D) and 225.7003-3(b)(3). (The Specialty Metals requirements and the COTS exception for fasteners are discussed generally here). These are two separate “Buy American” requirements, and companies should be careful in distinguishing between “normal” fasteners (where COTS is okay) and “specialty metal” fasteners (for which COTS is acceptable only in limited circumstances). How do you know which one is applicable? Start with determining whether you have regular metal fasteners or “specialty metal” fasteners. That should be the threshold question you should be considering.

Increasing Domestic End Product Price Evaluation Preferences

Importantly, the BAA does not strictly prohibit buying foreign-made products; there are many exceptions for when the government does not need to “Buy American.” One of the most common exceptions is when the domestic product is more expensive than the foreign alternative. The FAR implements this exception by using certain price evaluation techniques – offering a price evaluation preference to those contractors providing domestic end products and adding a certain evaluation penalty to the offer containing foreign-made products. Currently, large businesses offering domestic products receive a 6 percent price preference, and small businesses a 12 percent preference, when compared to an offer containing foreign-made products. (Under the DFARS, both businesses receive a 50 percent price preference – a huge preference for domestically manufactured goods).

Under the proposed rule, the price evaluation preference for large businesses offering domestic products will increase from 6 percent to 20 percent, and the preferences for small businesses will rise from 12 percent to 30 percent. (The FAR Council confirms the 50 percent preference under the DFARS will remain unimpacted). What this means is that, while previously a foreign-made product could be as little as 6 percent cheaper than the domestic option, the new rule would require the foreign-made product to be between 20-30 percent cheaper. Turned the other way, under the proposed rule, the domestic product may be between 20-30 percent more expensive than a foreign-made alternative before the BAA exceptions are available. This means that the government is willing to pay a significant premium for domestic products, seeming to make the BAA more true to its name.

Summary and Conclusion

Here is a brief summary of the key proposed changes:

With comments on the proposed rule due by November 13, 2020, contractors may wish to take this opportunity to better educate the FAR Council on the impact such drastic measures taken by the proposed rule would have on supply chains, not to mention the cost of the final end product deliverables (once you have factored in all of this new compliance cost). However, given the clear message of both Republicans and Democrats going into the November elections, we anticipate little movement from the policy of increasing domestic preferences, regardless of who ultimately wins. Joe Biden’s Buy American priorities are not that different from Donald Trump’s.

Thus, though these changes only are applicable to acquisitions subject to the BAA, which typically applies only to lower value contracts (less than $182,000 for supplies; less than $7,008,000 for construction)[2] – all contractors are encouraged to familiarize themselves with these proposed changes. Contractors should consider now taking stock of those items manufactured using steel or iron and determining whether those products are made “predominately” (or more than 50 percent by cost) from iron or steel. Contractors also should begin assessing and documenting their compliance with the BAAs new requirements, generally, including the heightened domestic content requirements. This includes a review of products acquired throughout the supply chain, as the impact of these changes also will flow throughout the entire supply chain.

Remember, even though comments on the proposed rule are due by November 13, 2020 (after the election), the rules are unlikely to change based on the outcome of the election. What that means is that 2021 will likely bring new Buy American requirements, whether suppliers like it or not.

FOOTNOTES

[1] The FAR Council recognizes these changes also impact Department of Defense (“DOD”) procurements and applicable regulations. Accordingly, the Council advises the same changes will be implemented in the Defense Federal Acquisition Regulation Supplement (“DFARS”) through DFARS Case 2019-D045.

[2] Higher value contracts are typically subject to the Trade Agreements Act, which exempts products manufactured by our free trade agreement partner countries.

Syndicated from Sheppard Mullin